Telkomsel Enterprise hosted an exclusive roundtable titled "Winning with Predictive AI: Smarter Strategies for Customer Growth," bringing together over 20 Chief Marketing Officers (CMOs) from Indonesia's banking and financial industry. The event, led by Telkomsel’s Chief Strategic Planning Officer, Wong Soon Nam, highlighted the transformative potential of predictive AI within Telkomsel DigiAds solution in accelerating customer acquisition and engagement within the financial sector.

The session commenced with an industry insights presentation by Craig Macdonald, a partner at McKinsey & Company, who provided compelling data on the rapid adoption of artificial intelligence (AI) and generative AI (Gen AI). According to the latest McKinsey report, AI adoption reached 72% in 2024, with Gen AI adoption growing from 33% in 2023 to 65% in 2024. However, despite these gains, the full potential of AI in marketing remains untapped, with only 15% of companies successfully capturing value from AI initiatives.

Traditional AI has delivered a 10%+ revenue increase for just 4% of companies and a 10%+ cost reduction for 6%, while Gen AI has shown slightly better results, driving a 10%+ revenue increase for 7% and cost reductions of over 10% for 15% of businesses. For financial institutions, marketing and sales represent the largest opportunity, with the combined annual value of AI and analytics estimated at over $620 billion. These insights underscored the immense potential for AI in transforming customer engagement and operational efficiency within the financial sector.

A panel discussion, featuring Indra Utoyo, President Director of Allobank; Arief Pradetya, Vice President of Digital Advertising at Telkomsel; and Craig Macdonald, delved into practical applications of predictive AI in customer growth strategies for the banking and finance industry. The panelists explored how predictive modeling can address evolving customer expectations for hyper-personalized experiences. Indra Utoyo emphasized the effectiveness of predictive AI, noting significant improvements in advertising performance when moving from broad interest-based targeting to propensity-based models.

The discussion further underscored the value of comprehensive big telecommunications data as a critical tool for enhancing customer understanding and engagement. When integrated with first-party data, comprehensive big telecommunications data enables financial institutions to craft more precise, data-driven strategies tailored to every stage of the customer lifecycle. This synergy between datasets allows for a richer understanding of customer behavior, unlocking new opportunities for personalized engagement.

Indra Utoyo shared Allobank’s remarkable success using Telkomsel DigiAds, which significantly optimized its customer acquisition efforts, leading to an impressive 60% growth. He also highlighted the effectiveness of predictive modeling in delivering 2-4x uplifts in performance by shifting from broad interest-based audiences to propensity-based targeting, demonstrating its critical role in driving impactful marketing outcomes.

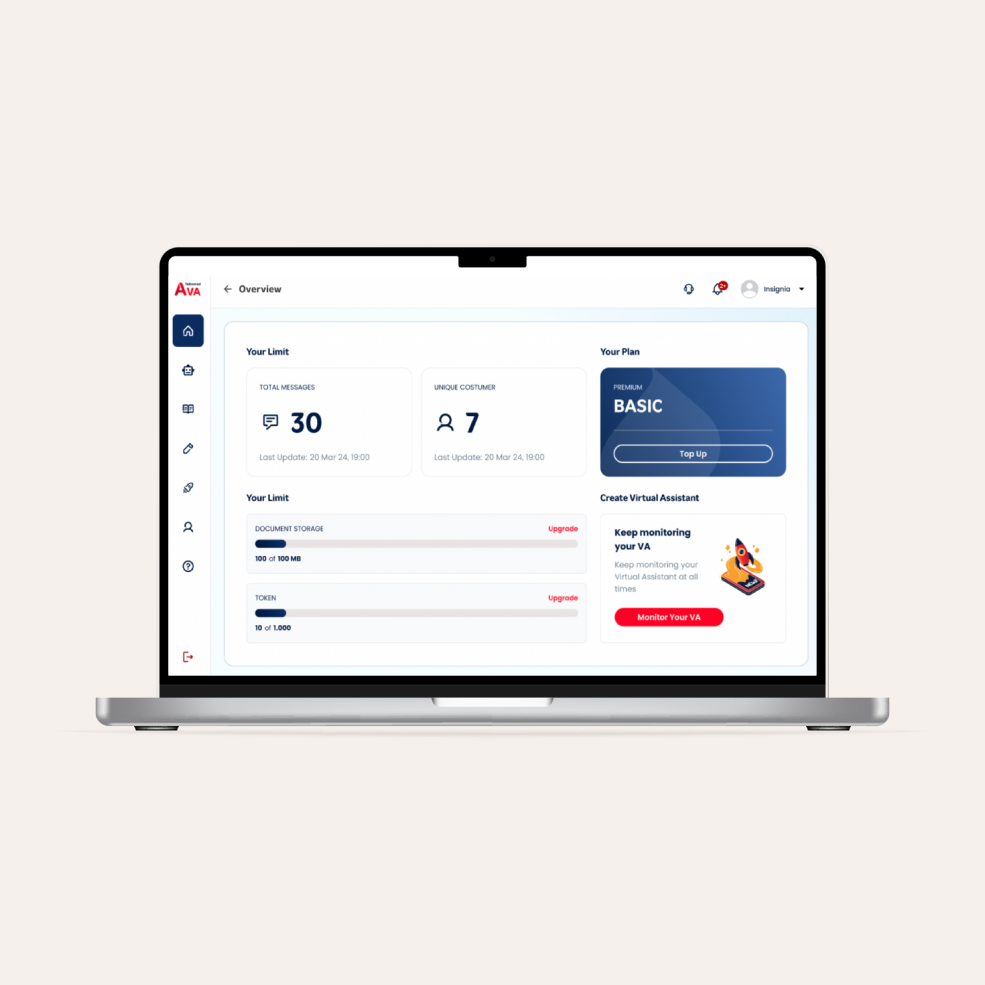

While the potential benefits of predictive AI are vast, the panelists also addressed the ethical and operational challenges associated with its implementation. Issues such as data privacy, security, and algorithmic bias were discussed, with Arief Pradetya emphasizing Telkomsel’s commitment to privacy-safe advertising solutions. He explained that Telkomsel’s predictive models are optimized with human oversight and representative data samples to ensure ethical and unbiased outcomes.

The roundtable concluded with a forward-looking discussion on how organizations can integrate predictive AI into their operations effectively, offering actionable advice for businesses exploring AI solutions. Panelists encouraged businesses to start small by testing AI-driven strategies on a limited scale and scaling only the approaches that prove successful. They emphasized the importance of close collaboration with trusted data partners to maximize outcomes and highlighted the need to prioritize high-quality data as a foundation for driving effective AI-driven initiatives. These practical recommendations provided attendees with a clear roadmap for leveraging AI to achieve meaningful results in their organizations.

As the demand for personalized experiences grows, predictive AI is becoming a crucial tool for driving customer engagement and growth in the banking and finance sector. Telkomsel DigiAds stands at the forefront of enabling this transformation, empowering industry leaders to harness the power of telecom data and AI to meet their business objectives and adapt to the evolving market landscape.